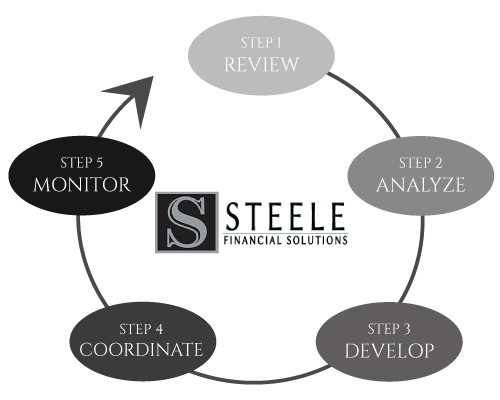

Step 1: Review

Review your individual situation and personal objectives. Every family’s financial

situation is unique. That’s why it’s so important to find out as much as we can about you

and your financial goals. The more we know about you, the more precise recommendations we

can make and the more we can help you. As a result, we may take some time to discuss your

objectives, concerns and goals — the things that really matter to you. This is the basis for

the first meeting with anyone we sit down with. There is no cost for this. Clients find the

experience of being able to sit down with a caring, local and trusted professional is of

great value.

Step 2: Analyze

Analyze your current financial picture and review your needs. We work with you to identify

and prioritize your objectives and then help establish what needs to be done, if anything,

to make sure you are on track to accomplish your goals. This is important because we live in

a world of unlimited choices. People often fail to achieve objectives because they try to

accomplish too much at once or don't know where to start. By breaking down your goals to

simple, actionable steps, a better and clearer financial future comes into focus.

Step 3: Develop

Develop and implement a strategy to help you achieve your goals. Based on our conversations

and analysis, we can recommend the steps that it will take to help you achieve your

financial goals. It's your money so it's always your final decision each step we take. You

are always in the driver's seat, but we're like your GPS helping you get to where you want

to go. We move 1 step at a time so things are easy to understand and follow. Our goal is

always peace of mind each step along the way.

Step 4: Coordinate

Coordinate your financial activities. We regularly coordinate insurance and financial

activities for clients with the other members of their team of financial, tax and legal

advisors*. We can do the same for you. Even when you aren't thinking about your finances, we

are!

Step 5: Monitor Progress

We regularly monitor progress and provide ongoing service over time. Strategies may need to

be adjusted periodically as your life and the economy changes. We will work with you over

the years to help keep your goals and plans on track with the passage of time. We reach out

to clients regularly to update them on their investments and so on. We encourage clients to

use us a resource for advice on all financial related matters.